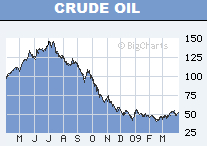

Someone else besides Culture Change has seen the financial meltdown and the Depression as resulting from the record high oil prices that led up to $147 per barrel last July. The Wall Street Journal last week confirmed our view. Its analysis is based only on what happens to housing prices and commutes when gasoline prices stay high.

We need not limit our analysis to gasoline or housing. Petroleum products all rose and gouged the economy hard. Direct and hidden subsidies were costing oil users much more than the nominal record prices. And today's prices are likely double or more than the posted prices.

"This is what petrocollapse looks like." Prices had been swinging higher for a few years, enough to sap the economy of its accustomed cheap energy. It was after two months of financial collapse in late 2008 that I first began saying and publishing, "This is what petrocollapse looks like." However, with collapsed oil and gasoline prices, people could now forget some immediate stress: they now cared about money issues in general, rather that what has underpinned wealth all along: limited resources.

Yet, the oil-price/Depression connection has been missed by almost everyone, who thought that the mortgage bubble had caused a recession. But what enabled all that sprawling home and commercial building? Answer: cheap (subsidized) energy. What was the infrastructure involved? Answer: petroleum, through and through, that we also depend on perilously to feed ourselves.

As peaking oil extraction is marked by an inexorable supply-decrease afterward, the end of economic growth is automatic. And industrial society is not set up for a steady-state economy that works with the ecosystem sustainably. This picture gets worse, a view I base on my previous career as an oil-industry analyst (I was called The Oracle by Chevron's Vice Chairman before I quit industry in 1987):

- There's no substitute, on the whole, for petroleum and its ability to comprise so many "essential" products.Because of the potential for the worst outcomes from lack of preparing for petrocollapse now underway, the need for transitioning to a car-free society is urgent. And for the sake of the climate, the driver of the big bad American vehicle needs to be curbed. The car bubble may have burst, but there's no proactive policy or movement to follow through with intelligent planning.- Even if some alternative technologies or fuels could compare with cheap oil's super high net-energy ratio, which they never have, the most promising and benign of them are just electricity producers.

- As oil industry authorities such as Matthew Simmons have made clear, the energy crisis that is unfolding is a liquid-fuels crisis.

- At root, it's not an energy crisis but a culture crisis, as pointed out by M. King Hubbert who developed the peak oil concept.

- Petrocollapse will not only happen due to a "run on the energy bank" -- creating strife and disaster, as Rep. Roscoe Bartlett said as he quoted me in Congress in May of 2005, because:

- The oil industry is not set up for a reversal of growth. The common assumption even among peak oilists is that there will be a gradual decline in extraction and an intact, integrated oil industry to refine and distribute the myriad products to billions of people. This wrongful assumption has the potential to cause tragedy in itself.

Another reason to not only end car culture but to pull the plug on the global-warming economy is that there's a better way of living than competing for dispiriting jobs. Most jobs exist to enrich the greedy few who are blinded by their own propaganda regarding civilization and science. (For positive survival-options, take a tour of CultureChange.org and other websites such as The Farm's Ecovillage Training Center's.)

"Did the Oil Price Boom of 2008 Cause Crisis?"In commenting on the Wall Street Journal story, journalist Paul Nellen wrote, "It was quite clear from the very beginning that the oil price shock in 2008 and the financial collapse last year have been strongly connected. No one talks about it because this finding could cause major anxieties and even political unrest for the dark future to come." He credits the earliest prediction of today's crash and debt crisis to 2005 by Colin Campbell, the geologist who founded the Association for the Study of Peak Oil and Gas. Unfortunately, Campbell has been characterizing peak oil as "the beginning of the second half of the age of oil." I disagree, as we come from opposite ends of the oil industry. He was disappointed at Culture Change's 2002 project Committee Against Oil Exploration, as he still thought like an oil man. But in 2005 he published my essay "End-Time for the USA upon Oil Collapse - A scenario for a sustainable future."

Wall Street Journal

April 3, 2009

By Justin LahartReeling from the housing bust and the banking crisis, it’s hard to think that the energy shock — the one that carried the average price of gasoline to a peak of $4.11 a gallon last July — was much more than a minor player in the economic downturn. But there’s the uncomfortable fact previous oil shocks, like the ones that came with the 1973 oil embargo, the 1979 Iranian revolution and the 1990 invasion of Kuwait, were also associated with recessions. And the 2001 recession, too, came on the heels of a run-up in oil prices.

In a paper presented at the Brookings Panel on Economic Activity Thursday, University of Calif.-San Diego economist James Hamilton crunched some numbers on how consumer spending responds to rising energy prices and came to a surprising result: Nearly all of last year’s economic downturn could be attributed to the oil price shock.

As he writes on his blog, that’s a conclusion that he doesn’t quite believe in himself. We’d like to think that, say, the seizing up of the credit markets this fall had something to with the economy falling off the table in the fourth quarter.

But then again, maybe what happened to oil prices had something to do with credit markets seizing up. The housing bubble saw people of lesser means traveling further afield to buy homes. That gave them long commutes that they were able to afford when gas was $2 a gallon, but maybe they couldn’t at $3. Housing in the exurbs got hit hardest, and one reason why is that high gasoline prices made it hard for people to lived in them to keep up with their mortgage payments, and hard for them to sell their homes without taking a steep loss. In some meaningful way, that has to have contributed to mortgage problems.

A more controversial argument on energy’s role in the credit crunch could go like this. Housing prices kept on climbing, but the Federal Reserve – laboring on the idea that it couldn’t identify bubbles and that even if it could, it shouldn’t pop them — didn’t do anything about them. But then rising oil prices started adding to inflationary pressures, so the Fed kept pushing rates higher, left them high even as housing prices collapsed, and was to slow to lower them when the credit crisis got rolling.

What can be good about the crash? People are getting closer together, doing more gardening, spending more time with one another due to less work, and -- crucially -- the environment gets a break. For example, the usual timber saies in the Pacific Northwest are not getting many bids, due to the construction downturn. Downsides include revenue loss for new schools. But why should there be new schools? We are going to have to limit population size and abandon endless growth. We can thus save the remnant of ancient forest essential to everyone's survival and continued evolution.

Collapse is not a comfortable feeling. In Pittsburgh on April 4th an emergency call to police left three officers dead: After an argument between a son and mother over a dog's urinating in the house, the mother threatened to kick out the son. To back this up, she had the cops come and invited them in. Her son blew them away, and she stated he had been stockpiling guns and ammunition "because he believed that as a result of economic collapse, the police were no longer able to protect society."

Michael Moore's movie Bowling for Columbine showed how gun happy so many U.S. citizens are. For their survival though dwindling resources and ecosystem crash as well, a community convergence would make more sense than individual arms maximization. And the lethal weapons known as cars need to be minimized now, for so many reasons. One more reason: don't let the pollution-industry corporados laugh all the way to their banks!

* * * * *

"End-Time for the USA upon Oil Collapse - A scenario for a sustainable future" Culture Change Letter #100, by Jan Lundberg:

culturechange.org

Did the Oil Price Boom of 2008 Cause Crisis?", Wall Street Journal:

blogs.wsj.com

The Farm's Ecovillage Training Center: thefarm.org

This report is Culture Change Letter #247

This article is published under Title 17 U.S.C. Section 107. See the Fair Use Notice for more information.