Has fracking reached its twilight?

Has fracking reached its twilight?I'll admit that I was completely caught off guard by the recent (and ongoing?) crash in oil prices. It'd be a stretch to say I'm embarrassed by my lack of foresight, although perhaps "dumb-ass" would be a bit deserving.

I would say I'm well enough versed with the reality of peak oil: I've read perhaps a couple dozen books on the topic, pored through several of the peak oil blogs (upon deciding to end my 5-year Internet hiatus a year ago), have seen several talks given by various writers on the topic, and I've attended two Age of Limits conferences.

Nevertheless, even though there were bloggers out there discussing the possible ramifications of low oil prices, its possibility still didn't register with me. I'll explain what I mean by that shortly, but to do that it'd be best if I first give a recap of what the mainstream media have been saying about collapsing oil prices the past couple of months.

If you've been following the recent oil-related news stories then you'll be familiar with two things: first, that the price of a barrel of oil has been crashing (to nearly 50% of its value half a year ago), and second, that OPEC (Organization of the Petroleum Exporting Countries) has refused to cut back its production, the hope being that a cut in supplies would have resulted in a rise in prices.

The first sign of trouble came after OPEC's November 27th meeting in Vienna whereupon it was announced that OPEC was going to maintain its production levels. Seeing how no explanation or elaboration was given, it was no surprise when the expected theories on the topic began appearing, and, of course, the conspiracy theories.

Some of the more mundane theories (not to say that there isn't any truth in them) include (1) that a rising US dollar has resulted in a downward pressure on the price of oil (since oil is priced and predominantly purchased in US dollars); (2) that Libyan production has increased and so contributed to a glut in supply; (3) that demand in Europe has been declining, also leading to a glut in supply; and (4) that increased production in the United States has meant increased consumption of domestic supplies and so a decrease in need for imports, once again resulting in a glut on world oil-supply markets. To name just a few.

Jumping over into the conspiracy theory realm (again, not to say that there isn't any truth in them), first is the notion that Saudi Arabia has colluded with the United States (something to do with the United States' Secretary of State having made a trip to Saudi Arabia a few months back), the intent being to bring down oil prices so as to crush the Russian economy (oil and natural gas make up about three-quarters of Russia's exports and more than half of its budget revenues).

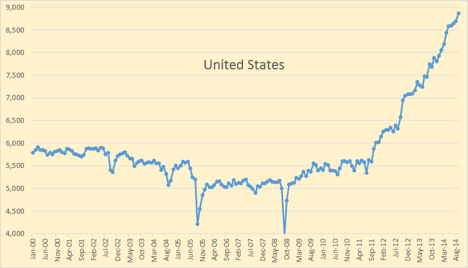

Another of the popular conspiracy theories is that rather than colluding with the United States, Saudi Arabia is actually attempting to crush the tight oil (otherwise known as shale oil or fracking) boom in the U.S., the idea here being to restore its and OPEC's dominance in the oil markets. For what's been going on is that since 2008 the United States has increased its production levels of oil – thanks to fracking – by some 4 million barrels a day, nearly doubling its previous extraction rate.

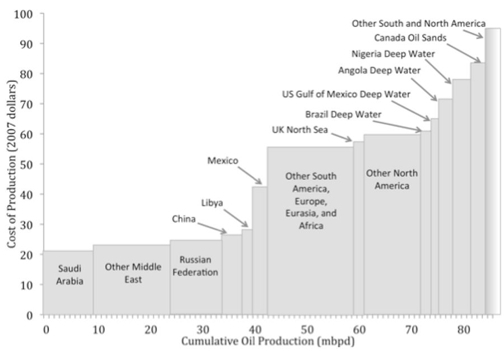

Secondly, since the peak in conventional oil supplies (that found under the ground and deserts and such) occurred in 2005, the only thing that's been keeping overall extraction levels increasing (in order to maintain worldwide economic growth) are the newly tapped unconventional oils – tight oil, tar sands, and deepwater offshore oil. And since tapping these forms of oil is similar to the extra effort required when scraping the bottom of a barrel, these unconventional sources require more energy and so cost more money to extract.

The idea then is that since tight oil in the United States is rather expensive to produce, if Saudi Arabia lets the oil price drop, this could very well bankrupt shale oil producers in the U.S. With a drop in production levels, prices would level off if not rise again, and not only would OPEC reap the restored higher prices, but they wouldn't have lost any market share.

That all being said, deciding to finally end the silence and partially put to rest lingering conspiracy theories, Saudi Arabia's oil minister was quoted on December 18th as stating that "The share of OPEC, as well as Saudi Arabia, in the global market has not changed for several years... while the production of other non-OPEC [countries] is rising constantly." Similarly, the oil minister for the United Arab Emirates stated that "No one likes the price drop, but it is not right that one party should interfere to fix the matter. [The party] responsible for the price fall [by causing the current oil glut] should contribute to fix the imbalance in the market."

In other words, while OPEC members have maintained their overall production levels of roughly 30 million barrels a day for about a couple of years now, it is the United States' fracking industry that since 2008 has significantly increased worldwide production levels, earning itself, no less, the rather idiotic moniker of "Saudi America."

A few days after the aforementioned statements were made, Saudi Arabia's oil minister again pleaded for non-OPEC members to cut back on production, then adding that those countries "will realize that it is in their interests to cooperate to ensure high prices for everyone." Furthermore, he also added that OPEC doesn't intend to cut supply "whatever the price is." "Whether it goes down to $20, $40, $50, $60, it is irrelevant."

And finally, in his response to conspiracy theories bandied about regarding Saudi Arabia pulling out the oil weapon on so-and-so countries, Saudi Arabia's oil minister stated that "Talking about such alleged conspiracies... is absolutely incorrect and indicates a misunderstanding in some minds... Our economy is based on strictly economic strategies, no more, no less."

So. I suppose that what one could do is wonder whether these statements are simply a smoke-screen for some nefarious, underhanded deals going on. But not only do I not have the faintest clue whether that's the case or not, and see no good reason for throwing uneducated guesses around, author Ugo Bardi put it even better when he said that "we tend to interpret the present downward cycle as the result of strategic choices or conspiracies, but this is mostly an illusion (the illusion of control)." That being said, what I do see as being important (and useful) is looking at why prices started to get so low in the first place.

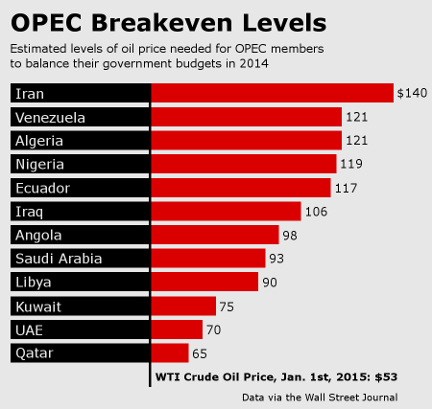

First off, certain OPEC members – namely Saudi Arabia, the United Arab Emirates, and Qatar – have either built up such substantial financial reserves and/or can extract oil so cheaply that they are able to bear the brunt of low oil prices for some time. Not so much others.

While Iran needs oil in the $100+ range in order to balance its books, Venezuela is in the worst position of all. While the Latin American country is already a very polarized nation, oil accounts for 95% of its export revenue. Low oil prices could therefore easily make a grim situation worse, some people having a propensity to become hostile when their standards of living continually depreciate. Likewise, a default on Venezuela's debt wouldn't be out of the blue.

But perhaps more pertinent and interesting is: what of the non-OPEC producing countries? This, I think, would be a much better area to look at, seeing how it would shed much light on how we got into this situation in the first place.

First off, it's worth noting that for the past three years or so, before oil's recent crash, the price of crude has been bouncing around the $100 mark. This was a relatively expensive range, particularly in comparison to its long-standing rate of $20-$40 per barrel for more than a decade, before its gradual then meteoric rise to $147 in 2008.

Since oil is entwined with the price of pretty much everything nowadays, its changes in price can have a significant effect on economies (as we currently [mis]understand the term). With higher and higher oil prices sapping a greater percentage from expenditures – be it of "consumers" or businesses – a price point is eventually reached where goods become so expensive that those who can't afford them anymore simply stop buying them. This is what is called "demand destruction."

When demand dries up and fewer goods thus end up being bought and sold, a glut in oil supply results, which ends up crashing prices. This is simple supply and demand. Along with other factors, this is what happened after the $147 oil price spike in July of 2008, and resulted in oil tumbling down to $32 by December of that same year.

While the ensuing low oil prices get seen by some as a boon (via the expectation that consumers will have more money to spend), the opposite problem actually kicks in – namely, "offer destruction." Since many businesses get forced to close down due to crashing oil demand and so in effect get fewer sales, and since a significant number of people get their hours cut or even lose their jobs, there often-times isn't enough money to pay for oil and other goods, regardless of how low the prices go. This is what happened in 2009, referred to as the Great Recession.

To return to the first paragraph of this post, this is where I got thrown off. To digress:

As mentioned earlier, 2005 is seen by some as the year that conventional supplies of oil peaked. It is because of this (and a few other factors, like speculation) that oil climbed to $147. Although prices subsequently crashed due to demand destruction, they eventually made their way back up, to the point that several unconventional forms of oil (shale oil/fracking, tar sands, and deepwater offshore oil) became somewhat profitable.

The problem with peak oil is that when (if?) growth kicks in again, and since more and more energy is getting used, soon enough the increasing levels of energy-use may very well butt up against maximum extraction levels, resulting in a shortage in supply and causing the whole demand and offer destruction cycle to kick back in again.

Furthermore, and as far as one theory goes, higher highs and higher lows will occur. That is, instead of maxing out at $147 per barrel, oil will reach, say, $200 per barrel, before crashing down to $80 or so instead of $40. And so forth.

And it is because of this notion that peak oil pulled a fast one on me. Expecting the higher high having to happen, what I didn't clue into was that oil prices at a high enough level for a prolonged period of time would be enough to have a similar effect as a quick rise to $147.

Case in point, one can look at countries that have recently slipped into recession or simply haven't gotten out since 2009 – Greece, Spain, Italy, Brazil, and so forth. Furthermore, some of the more robust and rich countries are seeing their growth wane – Japan, China, Germany, to name just a few. For what is a slowdown in Europe leads to fewer consumer purchases from China leads to less iron ore and coal bought from Australia.

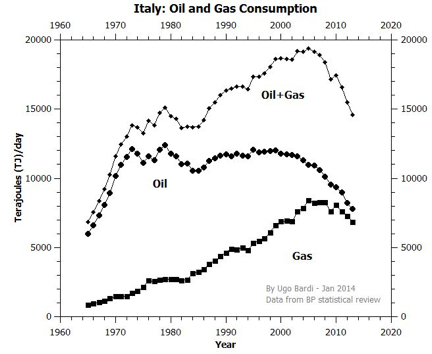

For a closer look, take a look at Italy. Oil and gas consumption peaked in 2004 and has been on a decline ever since. According to Ugo Bardi over at Resource Crisis, "Italy is in full collapse." One not only sees that industries are closing down, but also that restaurants are popping up in the attempt to attract the wallets of globe-trotting, placeless tourists, along with all the chic restaurant-hoppers. What is being witnessed, says Bardi, is "unreal."

Unfortunately, and much like the aforementioned countries, if one is looking for solid explanations about these economic collapses from mainstream news sources, then one is pretty much SOL. As Bardi then explains,

When the crisis is mentioned, different culprits periodically appear in the first pages of the newspapers: the Euro, the European Union, politicians, immigrants, government employees, bureaucracy, lazy workers, terrorism, femicide, Angela Merkel, Vladimir Putin, Silvio Berlusconi, and more. It is a cycle that never stops, it keeps turning, every time pointing at something - new or old - that the government will target to solve the crisis once and for all.In turn, not only could low-priced oil ($20!?) usher in another Great Recession via a meltdown of the oil market, but the newly enshrined oil ventures are at serious risk of collapse, and whose bubble bursting could be akin to the recent housing bubble. (To be fair, I can't imagine oil reaching that low if not staying there for very long, for the very simple reason that any number of unfortunate conflicts around the world could cause its price to increase overnight.)

In short, many of the unconventional sources of oil require $100 prices in order to remain financially viable (or at least give that impression). Since many of the fracking plays in the United States are owned by independents who don't have the financial reserves to weather a prolonged period of prices below costs of production, things could get hairy.

Furthermore, since fracking is capital-intensive, drillers have borrowed ridiculous amounts of money in order to acquire leases, drill wells, as well as purchase and install processing equipment and infrastructure. And since fracked wells have both steep production increase levels and decrease levels, drillers have been forced to continually drill more and more wells to keep up the semblance of growth – and to keep the debt piling up. What's resulted is a junk bond market possibly akin to what was witnessed a few years back with the housing fracas.

And not to let all the boosters off the hook, for it was once again an all-too-giddy media that kept itself busy cheering on the latest (fraudulent?) money-making scheme, pumping up all the debt with nary a peep about any possible consequences.

And so what's going on now that prices have crashed? That would be sellers panicking to unload their energy-related junk bonds and other investments in unconventional oil and related industries, and it's anybody's guess as to how much of a collapse will occur in these fields – and if it's significant enough, if they'll even have a chance to recover.

And as mentioned earlier, a round of offer destruction is expected to kick in after a round of demand destruction. For instance, nearly 40% of the jobs created since 2009 in the United States have been in energy related fields, those being some of the higher paying jobs in the nation, a catastrophe to the U.S. economy if lost.

As John Michael Greer recently put it over at The Archdruid Report, "If I’m right, the spike in domestic US oil production due to fracking was never more than an artifact of fiscal irresponsibility in the first place, and could not have been sustained no matter what."

What we might be about to find out is how vulnerable the United States' shale boom is to low prices, and how profitable fracking actually is.

Regardless, what happens next is anybody's guess, and it would be a fool's game to try and give any predictions. Nonetheless, it's worth quoting Terry Lynn Karl from a recent conversation with Andrew Nikiforuk. "We are in a situation where oil supply limits can cause recessions and oil supply gluts can cause stock market failures."

The reasons to get off oil seem to be piling up.

* * * * *

About the author: After four years in the film studies program at Ryerson University in Toronto, Allan Stromfeldt Christensen decided to turn his back on filmmaking and refrained from submitting what became his final film into the short film program of the Toronto International Film Festival. He is currently finishing off his first book, From Filmers to Farmers: From Couch Potatoes to Potato Cultivators , which will be followed by the starting of a small fruit wine and cider operation (and the raising of goats), on an experimental, demonstration, and educational farm: The Centre for Recovering Filmmakers. The original article appeared on Allan's website fromfilmerstofarmers.com. For a condensed version of this article without the OPEC-related theories, see fromfilmerstofarmers.com - condensed.

Sources:

The image for fracking in twilight is via Imahornfan.

The graph for United States oil production levels is courtesy of Peak Oil Barrel.

The OPEC break-even graph is from Wall St. Journal data.

The image for Italy: Oil and Gas Consumption is courtesy of Resource Crisis.

The Cost of Oil Production for Various Projects and Countries graph is from

The Oil Drum.